All about Dubai Company Expert Services

Wiki Article

All About Dubai Company Expert Services

Table of ContentsHow Dubai Company Expert Services can Save You Time, Stress, and Money.Not known Facts About Dubai Company Expert ServicesDubai Company Expert Services Things To Know Before You BuyUnknown Facts About Dubai Company Expert ServicesSome Known Factual Statements About Dubai Company Expert Services

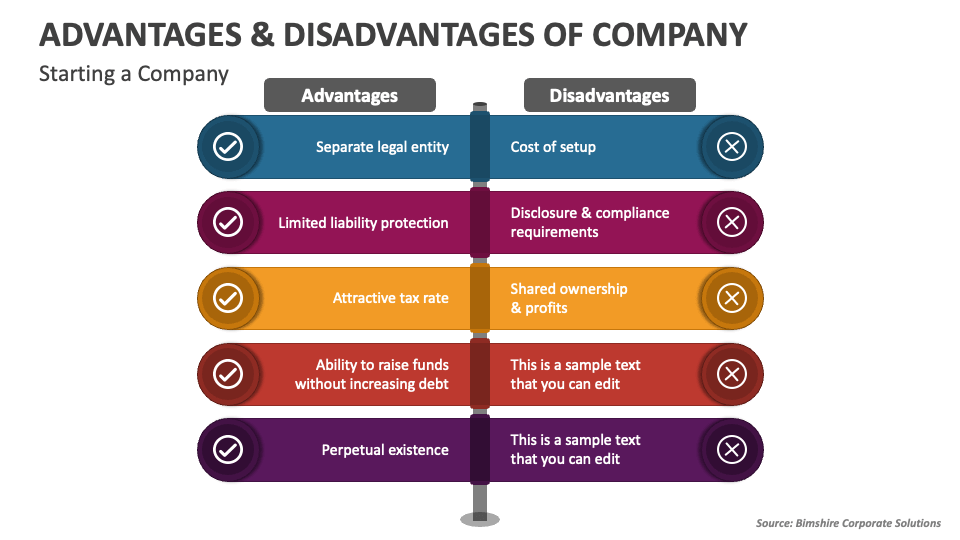

If one investor has more than 25 percent of the shares, they are dealt with in company legislation as 'individuals of considerable passion' since they can affect decisions made regarding the business. Personal minimal companies use a variety of essential benefits contrasted to businesses operating as single investors. As a single trader, you are personally accountable for all the debts as well as liabilities of your company.That lowers the danger of having your personal assets seized to pay for the financial debts of the organization if it falls short. A personal restricted company is regarded as even more considerable than businesses run by a single investor.

Associated: What is EIS? - alternative financing choices for local business Connected: What is SEIS? - Alternate local business financing Sole traders pay revenue tax and National Insurance policy contributions on the profits of business with an annual self-assessment income tax return. Dubai Company Expert Services. The rate of revenue tax and also National Insurance coverage contributions amounts that of a personal person as well as consists of the exact same individual allowances.

You can additionally increase resources by selling shares in your organization, although you can not provide them for public sale. Connected: A guide to crowdfunding and also the best crowdfunding websites UK When you register your business name with Business Residence, the name is safeguarded and also can not be used by any type of various other company.

Everything about Dubai Company Expert Services

If Business Residence acknowledge a coordinating name or a name that is very similar, they will recommend business and also reject to provide permission. This level of protection makes it challenging for other business providing copies of your products can not 'pass-off' their products as genuine. Related: Legal aspects of starting a small company.As dividends are taxed at a reduced price, this will certainly lower your tax obligation expense as well as offer a much more tax efficient approach of reimbursement compared to salary alone. There are also various other ways to take money out of the business as a director, consisting of incentive payments, pension contributions, supervisors' loans and exclusive financial investments.

Sole traders do not have the very same flexibility. They take earnings from the earnings of the business and the earnings is strained at basic personal earnings prices.

8% and its per capita GDP in 2015 is estimated at even more than $80k. Its gross nationwide savings are nearly 50% of its GDP. It exports almost S$ 500 billion well worth of exports yearly with the outcome that this country with only 5. content 25 million people has generated the 10th biggest international money gets on the planet.

The Ultimate Guide To Dubai Company Expert Services

Likewise, the personal tax obligation price starts at 0%, rises very progressively to an optimum of 20% for earnings above S$ 320,000. Corporate profits are not dual exhausted when they are passed to shareholders as rewards. To put it simply, dividends are dispersed to investors tax-free. Singapore bills one of the least expensive value included tax prices in the world.These agreements are made to guarantee that financial deals in between Singapore as well as the treaty nation do not experience dual taxation. Singapore supplies Unilateral Tax Credits (UTCs) for the situation of nations with which it does not have a DTA - Dubai Company Expert Services. Thus, a Singapore tax obligation resident firm is very not likely to experience double tax.

You do not require any regional companions or shareholders - Dubai Company Expert Services. This allows you to begin a company with the type of capital framework that you desire and also distribute its possession to suit your investment requirements. There are no limitations on the quantity of resources that you can bring from your residence country to invest in your Singapore business.

No tax obligations are enforced on resources gains from the sale of a business. This frictionless movement of funds across borders can offer extreme flexibility to a company.

5 Simple Techniques For Dubai Company Expert Services

For nine successive years, Singapore has placed number one on World Bank's Convenience of Doing Service survey. It takes less than a day to include a new firm.

The port of Singapore is among the busiest in the entire world as well as is identified as a significant International Maritime Facility. Singapore's Changi Flight terminal is a globe course airport terminal that accommodates approximately 20 million passengers each year as well as provides convenient flights to nearly every major city in world.

Singaporeans are a few of the most efficient as well as well qualified workers on the planet. The country's exceptional education and learning system creates a labor force that is proficient at what it does, yet on earnings it is very affordable with other countries. Singapore is perceived as a guideline following, well-functioning, modern and honest nation.

By situating your organization in Singapore, you will certainly indicate professionalism and trust as well as high quality to your customers, companions and also vendors. The very first perception they will have of your organization will certainly be that of an expert, qualified, sincere, and well-run company.

Unknown Facts About Dubai Company Expert Services

Take news into consideration the following: The rights as well as lawful responsibilities of those who take part in business That controls the company as well as the degree of control you wish to have How complex you want the business's framework to be The life-span of business The finances, including taxes, financial obligation, and also responsibilities Your over factors to consider will certainly determine the kind of company you'll produce, however you must most likely obtain lawful recommendations on the most effective kind of firm for your scenario.

This is just one of the easiest means to begin an organization and also one of the most usual kind of organization. Like a single proprietorship, visit this page a collaboration is simple to produce, but it involves two or even more individuals. In this kind of configuration, participants may equally divide the earnings and also losses as well as take on the obligation, unless a written agreement defines just how these points are to be shared.

Report this wiki page